Vehicle Mileage Log Book Template Download

Auto mileage log is maintained by business professionals and athletes to keep track of traveled distances. An accurate auto mileage log proves really helpful to record day to day travel distances. Commercial truck drivers and car owners are required to keep detail mileage log for the regular business related trips. Different people like runners, swimmers and cyclists prepare mileage logs to track the performance during training sessions. Mechanical Conveyors Selection And Operation Pdf Converter.

It is important to update auto mileage log regularly because it will help you in the audit process. Auto mileage log will help you to get tax deductions on your income tax return.

This free mileage log template for Excel will help you track your business drives for tax purposes. Have you covered. Download this Excel mileage log to manually keep track of your miles. The IRS does want to know the beginning mileage of your vehicle at the beginning of the year, though.

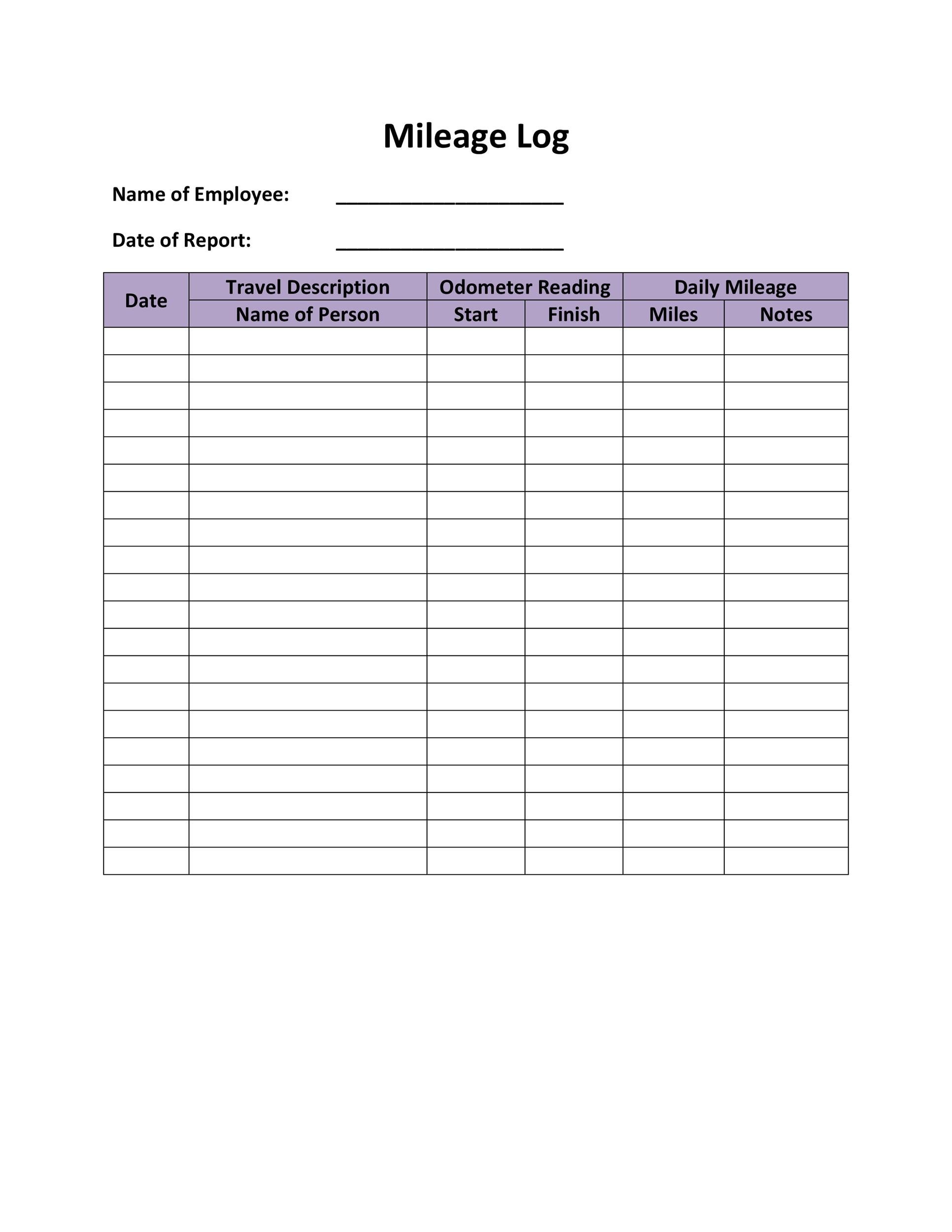

Auto mileage log should contain date of travel, starting and ending of odometer reading, total miles drive and the purpose of the travel. Uses of Auto Mileage Log Mileage logs are used to keep track of distances traveled for the work purpose. If you are using car of the company then you have to keep the record of mileage log.

Some companies pay certain amount per mile so you have to prepare auto mileage log to get compensation. Here is preview of this Free Auto Mileage Log Template created using MS Excel, Keep Proper Track of Your Travel You have to keep track of following travels: • Travel to and from offices of customers for meetings and other official purposes related to your company. • Delivery of goods and services. • Use of vehicle and voluntary work. It is really important to record miles or kilometers you have travelled for the office and personal purpose. If you are a self-employed person then you can get tax relief on total cost of travel. If you are working for an employer then record of total mileage will help you in the audit process.

Prove Beneficial for Tax Purposes A self-employed person can easily claim tax deductions for the costs incurred on the travel and the best way to separate your business and personal mileage is to design a mileage log that can also prove useful for the tax purposes. Your employer can claim tax relief also on your travel costs. Claim Your Money Back Auto mileage log will help you to claim your money back for work related travel. It is important to prepare a separate log for your job travels and include total mileage and consumption of fuel to charge accordingly. Essential Elements of Mileage Log It is important to use easy and accessible method to record total mileage and it will be good to use notebook to record all details in diary.